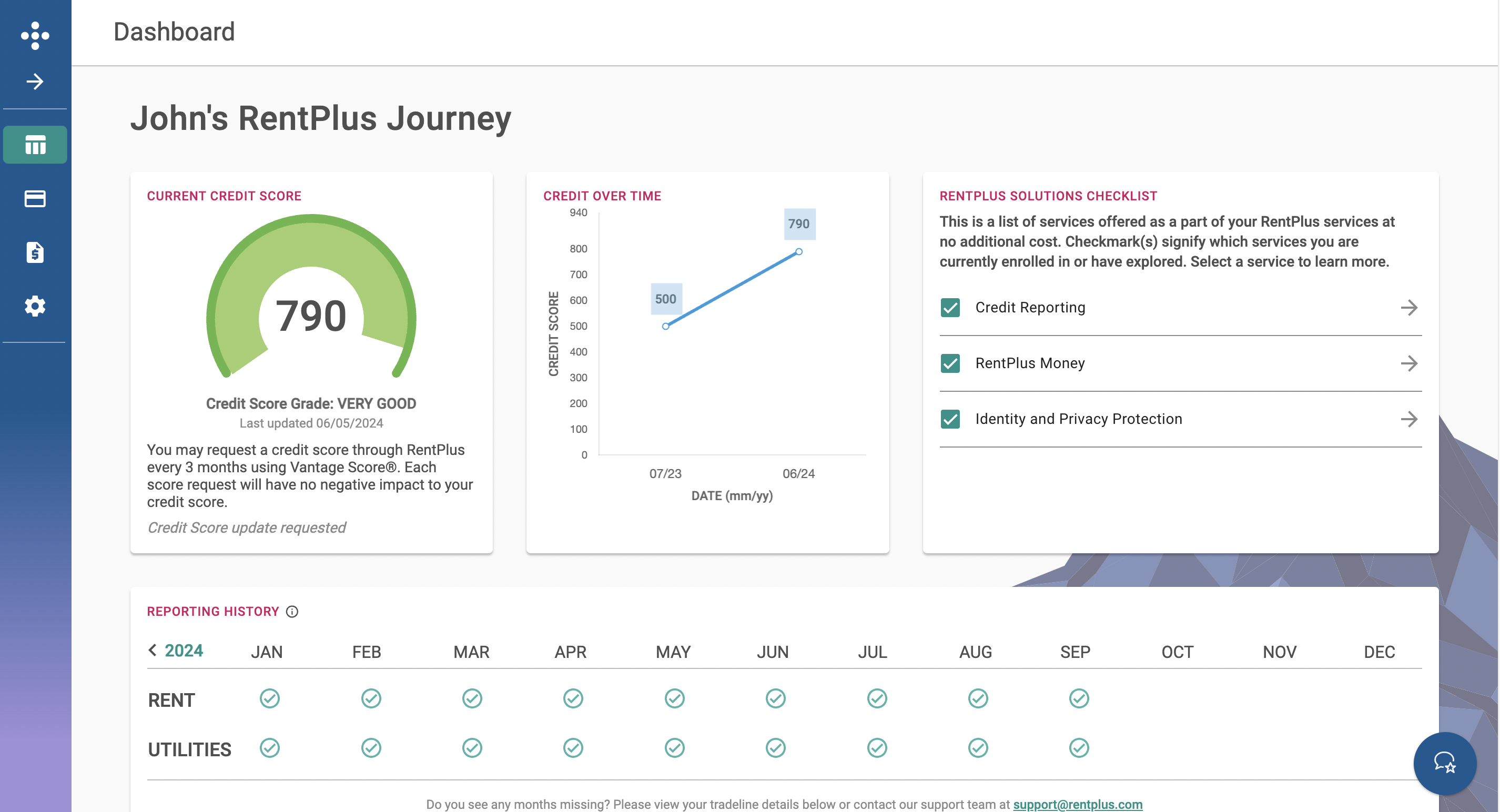

Unlock Your Financial Future

Unlock Your Financial Future with RentPlus®

Boost your credit score with our renter-focused financial services program! We make it simple for you to increase your credit score by paying your regular rent and utility bills.

Build your credit by paying your monthly rent on time!

Securing your financial future begins with a solid credit score. Luckily, RentPlus simplifies establishing credit by allowing renters to build their scores. We track your progress through rent reporting, so when you pay your rent on time, your payments will do the rest.

Credit Building

Credit Building

Credit Building

Plus Card & Banking

Fraud Protection

A Financial Amenity that will set you up for success

RentPlus provides rent reporting and a complete range of financial tools. Manage expenses, adhere to budgeting with helpful aids, access a tailored financial education program, and benefit from a $1 million fraud protection policy for peace of mind. Plus, a whole lot more.

A card that will build your credit AND help you save. Looking for an easy-to-qualify-for bank card that will help you save money instead of charge you unnecessary fees? There are no minumum income or credit requirements to qualify for the Plus Debit Card and Secured Credit Card.

What People are Saying about RentPlus

Maecenas faucibus mollis interdum. Integer posuere erat a ante venenatis dapibus posuere velit aliquet. Morbi leo risus, porta ac consectetur ac, vestibulum at eros. Donec id elit non mi porta gravida at eget metus. Maecenas faucibus mollis interdum.

John Dear

Maecenas faucibus mollis interdum. Integer posuere erat a ante venenatis dapibus posuere velit aliquet. Morbi leo risus, porta ac consectetur ac, vestibulum at eros. Donec id elit non mi porta gravida at eget metus. Maecenas faucibus mollis interdum.

Jane Doe.

This service has been invaluable to our family. We had just been through a foreclosure and our credit suffered greatly before we moved into our apartment. With this service, we have been able to raise our credit each month as we make our payments on time. We thought it would take years for our credit to improve, but we are in a much better place now than we were just a year ago.

Ashley M.

Midvale, Utah

Don't count yourself out if you already have an established line(s) of credit either! In my case, it improved my already good standings and made it easier for me when it came time to finance a new car! RentPlus is simple and easy! I have since recommended it to several friends who are also renting, and will look forward to utilizing this awesome service for years to come!

Nick P.

Hanford, California

My credit report was low because I didn't have much history or many cards, even though I'd never been late on a rent payment. Using RentPlus helped me show the world I was actually a qualified buyer. Thank you!"

Brynn S.

Logan, Utah

As someone who is working on building my credit so that I can purchase a home with the best possible interest rate I thought it was great that the amount I pay in rent would be reported to the credit bureaus. My rent is a substantial part of my expenses and having that amount reflected as an on-time payment each month just makes sense."

Tara O.

Norfolk, Virginia